After two months of near silence, Japan’s government has seemingly awoken from its slumber and kicked into high damage-control gear. On Tuesday, Prime Minister Naoto Kan, whose administration has come under fire for its slow and opaque response to the ongoing nuclear crisis at Fukushima, made two surprise announcements. First, that he would forgo his salary as PM until the situation at the embattled power plant was resolved; second, that Japan’s plans to expand its nuclear energy portfolio were officially off the table.

The announcement follows Kan’s request last week for Chubu Electric Power Company to suspend operations at its Hamaoka nuclear power plant, built in a coastal due for a big quake, until better emergency measures are in place. (Chubu agreed to the request on Monday.) Before March 11, nuclear power was pretty much the answer to Japan’s energy supply problems. Japan currently has 54 nuclear reactors that have been producing about 30% of the nation’s electricity. Last year, Kan’s government announced plans to build 14 new reactors that would expand that production to meet 50% of the nation’s electricity needs. Japan is world’s third largest consumer of electricity, and, as the largest importer of liquified natural gas and coal and third largest consumer of oil, has long relied on non-domestic fossil fuels for the majority of its electricity production. In an island nation without its own natural resources or space, nuclear seemed like the right way forward in order for Japan to distance itself from the volatility of the oil markets and to meet its pledge to reduce greenhouse gas emissions by 25% of 1990 levels by 2020.

The government has not yet backed down from that target, but it is certainly one of the things that will now be up for debate in forging a brand new energy policy. Kan, in sentiments later echoed by Environment Minister Ryu Matsumoto, said that new direction would focus on other renewables like wind, solar, hydro and geothermal, and conservation.

But because of the nation’s special attention to developing nuclear power since the oil crisis of the 1970s, the renewable sector is surprisingly anemic for a nation where expertise in renewable technologies is so high and where every gas station has approximately 24 different kinds of recycling bins. Less than 1% of Japan’s electricity comes from wind, solar, geothermal and biomass. Another 8% comes from major hydroelectric sources. Since the latter is considered more or less at capacity already, the expansion that Kan and Matsumoto are talking (assuming this plan makes into the next government, which is a subject for another time) about is going to have to come mostly from the sun, the wind or the earth.

Here’s a brief summary of where things stand in those sectors today:

Solar

Technologically speaking, Japan’s solar sector got off to a fast and early start in the 1980s, but it has since been overtaken by Europe. Japan currently has the third largest solar PV capacity installed, generating slightly more electricity than geothermal, but only rates fifth in terms of installation per capita. In 2008, according to Reuters, Japan produced 1.92 million kilowatts of solar power, of which 80% came from people’s homes.

Technologically speaking, Japan’s solar sector got off to a fast and early start in the 1980s, but it has since been overtaken by Europe. Japan currently has the third largest solar PV capacity installed, generating slightly more electricity than geothermal, but only rates fifth in terms of installation per capita. In 2008, according to Reuters, Japan produced 1.92 million kilowatts of solar power, of which 80% came from people’s homes.

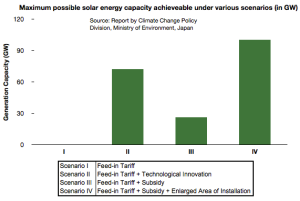

Still, of all the renewables outside of nuclear and hydro, solar has received the most concentrated attention from Tokyo. Though the government pulled back on them in 2006, subsidies for households to install solar panels were reinstated in 2009 in keeping with Tokyo’s stated goal of growing solar capacity by 2030 to 40 times 2005 levels. As a result, in 2010, domestic solar panel sales hit record levels. The government has also has guaranteed a premium price for solar power generated by homes and businesses that sell their surplus electricity to the grid.

Meanwhile, Japanese companies including Mitsubishi and Toshiba have also been expanding their solar production as the world’s interest in sustainable energy sources continues to grow. According to the Japan Photovoltaic Energy Association, solar panel exports to the U.S. increased 21% in 2009, while sales to Europe fell 4.3% the same year.

Wind

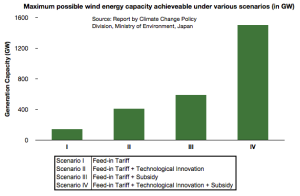

Japan’s installed wind power capacity took a great leap forward between 2000 and 2010, from 139MW to 2,304 MW, but has since lost momentum. Though Japan’s environment minister said on Tuesday that the Pacific coast of northeast Japan was suited for wind installation, and could eventually generate the more power than is currently being produced by the nation’s nuclear plants, severe weather, grid constraints and economic stagnation have been holding this renewable back.

Japan’s installed wind power capacity took a great leap forward between 2000 and 2010, from 139MW to 2,304 MW, but has since lost momentum. Though Japan’s environment minister said on Tuesday that the Pacific coast of northeast Japan was suited for wind installation, and could eventually generate the more power than is currently being produced by the nation’s nuclear plants, severe weather, grid constraints and economic stagnation have been holding this renewable back.

Here’s a description of the grid problem — perhaps the biggest hurdle because it involves that rather permanent factor of geography — from the Global Wind Energy Council:

Grid infrastructure continues to be a challenge for wind development in Japan. The leading regions for wind power development in Japan are Tohoku and Hokkaido in the north of the country and Kyushu in the south. The greatest electricity demand is concentrated in the center of Japan, while most potential wind power sites are located in remote areas where grid capacity is relatively small. Limited grid access and the monopolistic hold over the power grids by regional electricity companies, who use variability issues as an excuse for not investing in more capacity, have also hampered the development of wind generation.

Geothermal

Japan has the third largest geothermal energy potential in the world after the U.S. and Indonesia. But in terms of harnessing that heat and turning it into power, Japan only ranks 8th, after countries with drastically smaller populations, like Iceland and New Zealand. Today, Japan only generates about .1% of its electricity in 19 geothermal energy plants, many of which are located in the Tohoku region where the Fukushima nuclear power plant is located.

Geothermal power plants, once up and running, provide extremely cheap power with very low emissions. But the sector faces some serious challenges, not the least of which is getting investors onboard. Geothermal’s front-end cost is high in order to assess sites for potential and do exploratory drilling that doesn’t always pan out. Many people worry that the drilling, particularly for the kind of very deep wells which yield the most power, will cause geologic instability, which, considering that most places where geothermal potential exists are also places where people live with earthquakes, can be a hard sell.

Geothermal power plants also aren’t all that pretty. They release a lot of steam into the air and rely on networks of above-ground piping that can be a bit an eyesore. That particular problem is exacerbated in Japan, where the same areas in which geothermal potential is the highest are revered for their natural beauty and centuries-old onsen, or baths. There are nearly 8000 spa resorts around the country, attracting an annual 140 million bathers. In recent years, some members of the onsen industry who say the plants will disturb the baths have butt heads with Tokyo’s push for more small geothermal plants to be incorporated into localized energy portfolios.

Though Japan has not fully exploited its geothermal potential domestically, Mitsubishi, Toshiba and Fuji Electric are all major manufacturers of geothermal equipment. Together, they supply about 70% of the steam turbines and power gear used in the global geothermal industry, and they could stand to benefit greatly if there were a geothermal boom back home.